41 difference between coupon rate and market rate

Difference Between YTM and Coupon rates The YTM calculation takes into account: coupon rate, the price of the bond, time remaining until maturity, and the difference between the face value and the price. It is a rather complex calculation. The coupon rate, or, more simply stated, coupon of a particular bond, is the amount of interest paid every year. What is the difference between the coupon rate and market ... A. NSWER. Paper Title. What is the difference between the coupon rate and market rate? No. of Words. 539. PRICE. $5.00. User Ratings.

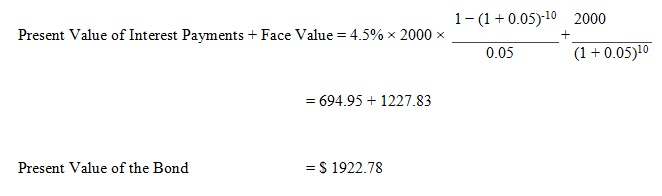

The Difference between a Coupon and Market Rate Dec 24, 2021 · Solution Preview. Coupon rate is the interest rate to be paid on the bond at regular interval. In this case coupon rate is 8%. If the face value of the bond is $1000, the holder of the bond will receive $80 at the end of every year during the duration of the bond.

Difference between coupon rate and market rate

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Difference Between Coupon Rate And Yield Of Maturity A coupon rate is a rate at which the interest payment of a bond is made to the investor. It represents the yearly interest rate paid by the bond with respect to ... What is the difference between coupon rate and market If the market rate turns lower than a bonds coupon rate holding the bonds is advantageous as other investors may want to pay more than the face value for the bond ’s comparably higher coupon rate . Bonds with higher coupon rates provide a margin of safety against rising market interest rates ” .

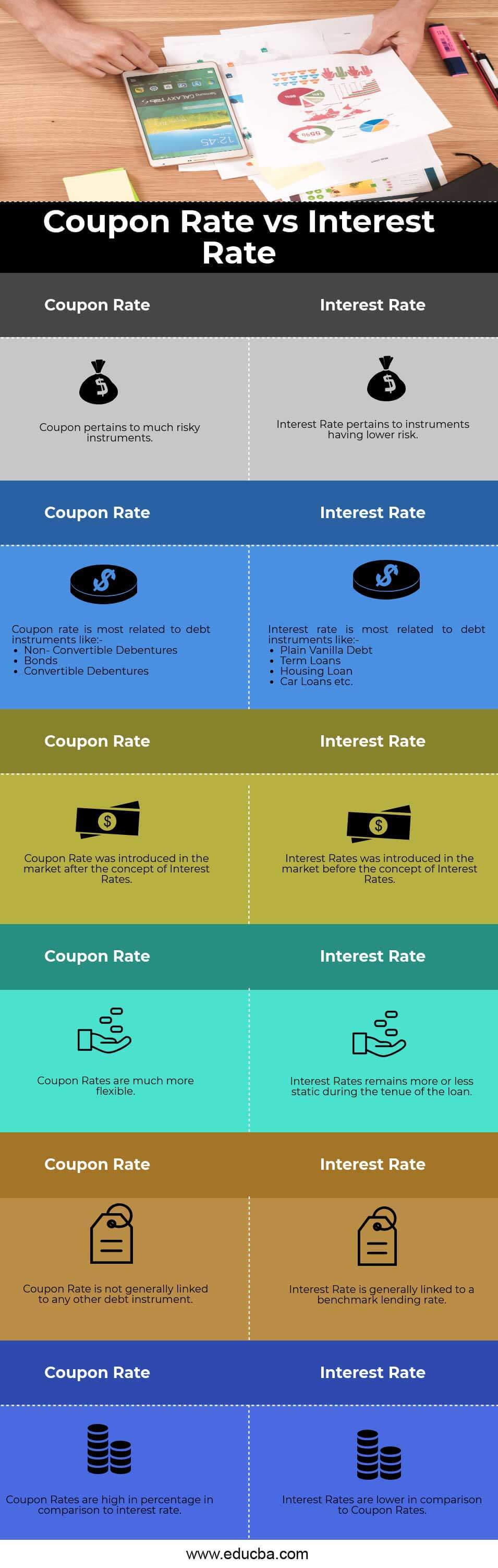

Difference between coupon rate and market rate. Yield to Maturity vs. Coupon Rate: What's the Difference? To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for... Solved The difference between the stated or coupon ... Answer = C ( Changes monthly ) Stated or coupon rate of the bond is made by the bond issuer. Coupo …. View the full answer. Transcribed image text: The difference between the stated or coupon interest rate of a bond and the market interest rate for similar investments: A. Never changes B. Changes daily C. Changes monthly. Bond Stated Interest Rate Vs. Market Rate | Pocketsense Because of the manner in which bonds are traded, the coupon rate often differs from the market interest rate. Tips A coupon rate is a fixed rate of return attached to the face value of the bond paid to the purchaser from the seller, while the market interest rate can change dramatically throughout the lifespan of the bond. Bond Basics Coupon Rate vs Interest Rate | Top 6 Best Differences ... The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requirements.

Coupon vs Yield | Top 5 Differences (with Infographics) On the basis of the coupon payment and face value of the bond, the coupon rate is calculated. The yield of the bond, on the other hand, is the interest rate on the basis of the current market price Market Price Market price refers to the current price prevailing in the market at which goods, services, or assets are purchased or sold. State the difference between a bond coupon rate and market ... Textbook solution for Financial Accounting 9th Edition Robert Libby Chapter 10 Problem 6Q. We have step-by-step solutions for your textbooks written by Bartleby experts! What is the difference between coupon rate and market ... What is the difference between coupon rate and market interest rate? " coupon rate: a contract term to determine the regular interest payments; fixed " market interest rate (yield): it varies depending on demand and supply conditions in the market; it is used to determine the fair value of a bond Finance exam 2 Flashcards | Quizlet It is also the expected return for an investor who buys the bond and holds it to maturity. The coupon rate determines the periodic interest payments made to investors. YTM is the expected return for an investor who buys the bond today and holds it to maturity. YTM is the prevailing market interest rate for bonds with similar features.

Solved What is the difference between a bond's coupon rate ... We review their content and use your feedback to keep the quality high. 100% (2 ratings) A bond's coupon rate is the actual amount of interest income that the holder of a bond earns each year. The coupon rate …. View the full answer. Bonds - Coupon and Market Rates Differ - YouTube Lesson discussing how the value of a bond changes when coupon rates and market rates differ. Looks at why a bond will trade at a premium, discount, or at pa... What is Coupon Rate? Definition of ... - The Economic Times The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 per cent, you will get Rs 200 every year for 10 years, no matter what happens to the bond price in the market. Quick Answer: What Is Current Coupon - WhatisAnything What is the difference between stated rate and market rate? What does a low coupon rate mean? What happens to the coupon rate of A $1000 face value bond that pays $80 annually in interest if market interest rates change from 9% to 10 %?

Important Differences Between Coupon and Yield to Maturity Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

What are the contract rate and the market rate for bonds ... Contract rate is known as a coupon rate (because older securities actually had coupons that were clipped and sent to paying banks for periodic interest). It is the fixed rate of interest for which ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,...

Coupon vs Yield | Top 8 Useful Differences (with Infographics) While calculating the current yield, the coupon rate compares to the current market price of the bond. During the tenure of the bond, the bond price remains the same till maturity due to the continuous fluctuation of the market price; it is better to buy a bond at the discount rate which offers handsome returns on the maturity at face value.

Difference Between Yield & Coupon Rate | Difference Between Difference Between Yield & Coupon Rate Yield vs. Coupon Rate Banking and finance terms can be confusing at times, especially when someone has very limited or no experience with a seemingly endless list of financial industry terms. Some words are frequently used together, which alters their meaning altogether. This is the case when using the terms 'yield rate' and 'coupon rate,'

What is difference between coupon rate and interest rate ... The coupon rate is the rate the bond at 100% face of value the bond, usually $10,000. But as interest rates change in the marketplace, the real value and interest rate of the bond will change. Let's say a 20-year bond comes out at 3.0%. And then Fed raises its funds rate, 50 basis points or 0.5%. That would push up all interest rates.

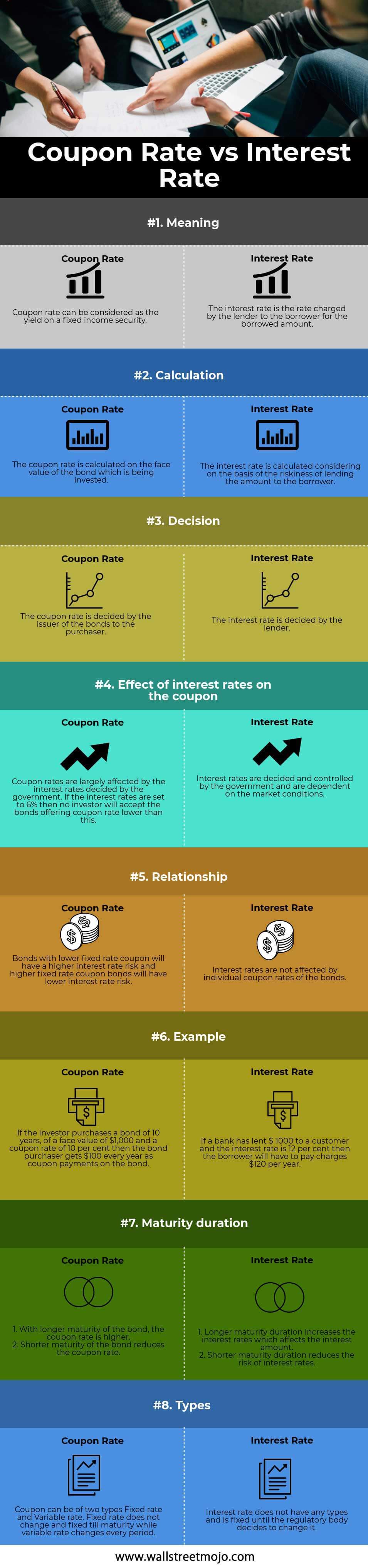

Difference Between Coupon Rate and Interest Rate | Compare ... What is the difference between Coupon Rate and Interest Rate? • Coupon Rate is the yield of a fixed income security. Interest rate is the rate charged for a borrowing. • Coupon Rate is calculated considering the face value of the investment. Interest rate is calculated considering the riskiness of the lending.

Difference Between Yield to Maturity and Coupon Rate ... The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. CONTENTS 1.

[Solved] Using a discount rate of 8 percent, and treating the average sales figures as annuities ...

Difference Between Coupon Rate and Interest Rate (With ... Main Differences Between Coupon Rate and Interest Rate Coupon rates are calculated on the fixed-income security, whereas interest rates are calculated on the amount which has been lent to borrowers. The coupon's face value determines the nominal value of the bond. Albeit the Interest rate's face value affected by the amount due on.

Coupon Rate vs Interest Rate - WallStreetMojo The coupon rateCoupon RateThe coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100%read moreis the rate of interest being paid off for the fixed income security su...

What is the difference between coupon rate and market If the market rate turns lower than a bonds coupon rate holding the bonds is advantageous as other investors may want to pay more than the face value for the bond ’s comparably higher coupon rate . Bonds with higher coupon rates provide a margin of safety against rising market interest rates ” .

Difference Between Coupon Rate And Yield Of Maturity A coupon rate is a rate at which the interest payment of a bond is made to the investor. It represents the yearly interest rate paid by the bond with respect to ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

.png?width=960&name=image (80).png)

Post a Comment for "41 difference between coupon rate and market rate"