39 bond yield vs coupon rate

Understanding Bond Prices and Yields - Investopedia A bond's yield is the discount rate that can be used to make the present value of all of the bond's cash flows equal to its price. In other words, a bond's price is the sum of the present value of ... Of coupons, yields, rates and spreads: What does it all mean? - YieldStreet At inception, the bond's yield is equal to its coupon, because the bond price is at par, or at 100% of the face value. So at issuance it has a 5% coupon and a 5% yield. Over time, several factors may affect the bond price - for example the issuing company performing poorly, or an increase in the risk-free rate - which would drag the bond ...

Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA 3. Interest rates influence the coupon rates. The current yield compares the coupon rate to the market price of the bond. 4. The coupon amount remains the same until maturity. Market price keeps on fluctuating, better to buy a bond at a discount which represents a larger share of the purchase price. 5.

Bond yield vs coupon rate

How Is the Interest Rate on a Treasury Bond Determined? Personal Finance Wealth Management Budgeting/Saving Banking Credit Cards Reviews & Ratings When is a bond's coupon rate and yield to maturity the same? Jan 13, 2022 · For example, if a company issues a $1,000 bond with a 4% interest rate, but the government subsequently raises the minimum interest rate to 5%, then any new bonds being issued have higher coupon ... Bond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

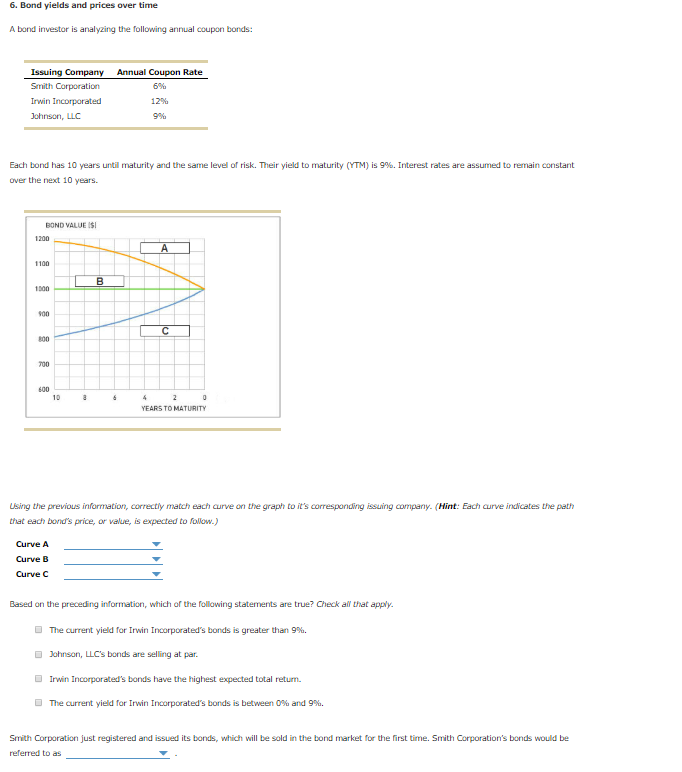

Bond yield vs coupon rate. Important Differences Between Coupon and Yield to Maturity - The Balance Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon. For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. ... Yield to maturity will be equal to coupon rate if an investor purchases ... Coupon Rate vs Yield for a Bond: Fixed Income 101: Easy Peasy ... - YouTube This video addresses "Coupon Rate vs Yield" for a Bond in a simple, kid-friendly way. PLEASE SUBSCRIBE (It's FREE!): ... Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Coupon Rate vs Yield Rate for Bonds | Wall Street Oasis Yield can be different than coupon rates based on the principal price of the bond. If the price is par at time of purchase and you receive par at maturity, then the yield and coupon will be the same. However, if you buy at a discount, say at 90 instead of 100, and receive 100 at maturity, all the while still receiving 10 (10% on principal of ...

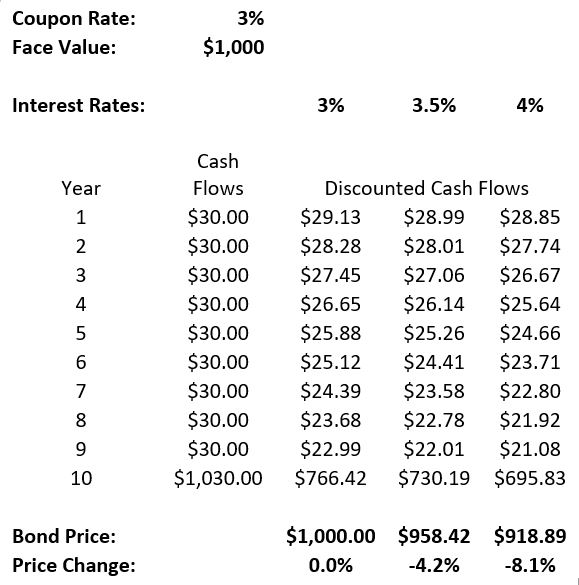

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo Key Differences. For the calculation of the coupon rate, the denominator is the face value of the bond, and for the calculation of the yield Calculation Of The Yield The Yield Function in Excel is an in-built financial function to determine the yield on security or bond that pays interest periodically. It calculates bond yield by using the bond's settlement value, maturity, rate, price, and ... Difference Between Current Yield and Coupon Rate So these two terms are essential to understand how the market works. Current Yield vs Coupon Rate. The main difference between current yield and coupon rate is that current yield is a ratio of annual income from the bond to the current price of the bond, and it tells about the expected income generated from the bond. Key Differences: Bond Price vs. Yield - SmartAsset To compensate for that, corporations issuing bonds at a lower rate must offer buyers a discount. Bond Price and Interest Rate Example. Let's say you purchase a bond from ABC Corp. that comes with a coupon rate of 5%. Three possibilities follow: The prevailing interest rate stays the same as the bond's coupon rate. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Coupon Rate vs. Yield-to-Maturity. The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? Thus, a $1,000 bond with a coupon rate of 6% pays $60 in interest annually and a $2,000 bond with a coupon rate of 6% pays $120 in interest annually. Key Takeaways. Coupon rates are the yields associated with regular interest payments made by bonds and are influenced by prevailing interest rates. A bond's yield is the rate of return the bond ... Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Bond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · A bond's current yield, however, is different: a percentage based on the coupon payment divided by the bond's price, it represents the bond's effective return. Coupon Interest Rate vs. Yield Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

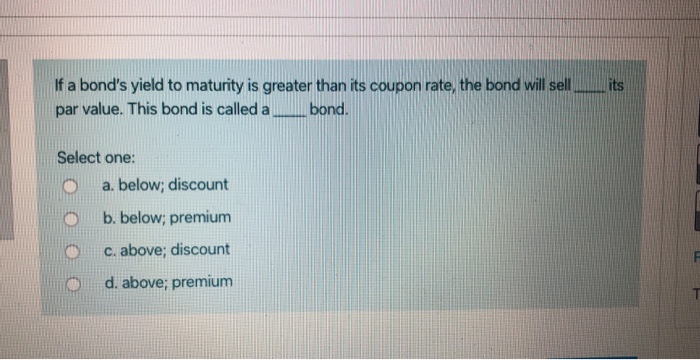

The current yield of a bond will equal its coupon rate when the bond is ... The current yield of a bond will equal its coupon rate when the bond is selling at par value. 44 minutes ago. Comments: 0. Views: 27. Share. ... What is the value of a 5-year 10% coupon bond with face value of $1000 if the yield is 4% per year? Assume that coupon payments are semi-annual. Round off to two digits after the decimal point.

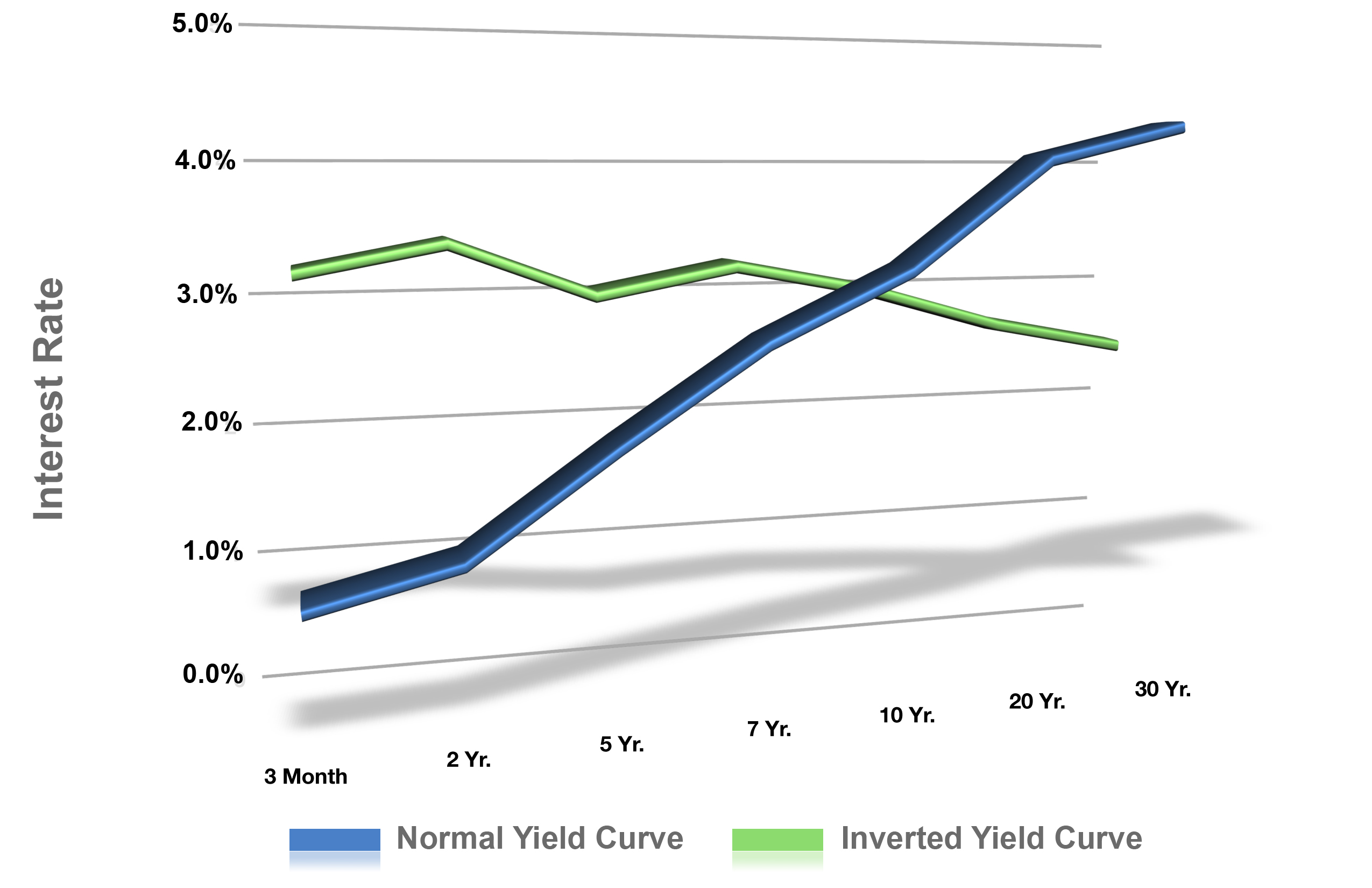

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) For example, consider a bond with a coupon rate of 2% and another bond with a coupon rate of 4%. Keeping all the features the same, bond with a 2% coupon rate will fall more than the bond with a 4% coupon rate. Maturity affects interest rate risk. The longer the bank's maturity, the higher the chances of it being affected by the changes ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? There are differences between a bond's yield rate and its coupon rate. The coupon rate influences market price and the market price influences yield. Education General Dictionary Economics Corporate Finance Roth IRA Stocks Mutual Funds ETFs 401(k) Investing/Trading

Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Bond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

Bond Coupon Rate vs Yield - YouTube When comparing two or more bonds, do you focus on the coupon rate or the yield. In this 60 second video, I explain why comparing the yield is key.Join the ne...

How are bond yields different from coupon rate? The coupon rate is often different from the yield. A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face value, the ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

When is a bond's coupon rate and yield to maturity the same? Jan 13, 2022 · For example, if a company issues a $1,000 bond with a 4% interest rate, but the government subsequently raises the minimum interest rate to 5%, then any new bonds being issued have higher coupon ...

How Is the Interest Rate on a Treasury Bond Determined? Personal Finance Wealth Management Budgeting/Saving Banking Credit Cards Reviews & Ratings

:max_bytes(150000):strip_icc()/GettyImages-182832748-af3f3d3824034fdaa66ac937fc2d7a40.jpg)

Post a Comment for "39 bond yield vs coupon rate"