43 coupon rate and yield to maturity

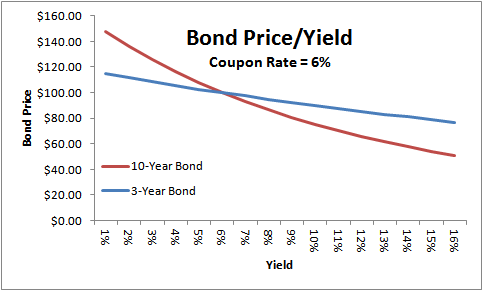

Bond's Price, Coupon Rate, Maturity | CFA Level 1 - AnalystPrep The smaller the coupon, the greater the interest rate risk Question A bond's price is forecast to increase by 4% if the market discount rate decreases by 100 basis points. If the bond market's discount rate increases by the same amount, the bond price will most likely change by: 4%. Less than 4% More than 4% Solution The correct answer is B. › ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Yield to maturity (YTM) is an important metric used in bond markets that describes the total rate of return that is expected from a bond once it has made all of its future interest payments and ...

Bond time to maturity coupon rate price yield to View full document. See Page 1. Bond Time-to- Maturity Coupon Rate Price Yield-to- Maturity (A) 5 years 10% 70.093879 20% (B) 10 years 10% 58.075279 20% (C) 15 years 10% 53.245274 20% The coupon payments are annual. The yields-to-maturity are effective annual rates. The.

Coupon rate and yield to maturity

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year, semi-annually. Assuming you hold the bond to maturity, you will receive 12 coupon payments of $125 each, or a total of $1,500. home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury Oct 11, 2022 · NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ... Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

Coupon rate and yield to maturity. Difference Between Yield to Maturity and Coupon Rate The coupon rate is 5.25% with a term to maturity of 4.5 years. Yield to Maturity is calculated as, Yield to Maturity = 5.25 + (100-102.50/4.5) / (100+102.50/2) = 4.63% Yield to Maturity can be identified as an important yardstick for an investor to understand the amount of return a bond will generate at the end of the maturity period. Yield to Maturity (YTM) - Meaning, Formula and Examples - Groww The formula of current yield: Coupon rate / Purchase price. Naturally, if the bond purchase price is equal to the face value, the current yield will be equal to the coupon rate. Current Yield = 160/2,000 = 0.08 or 8%. Let's say the purchase price falls to 1,800. Current Yield = 160/1,800= 0.089 or 8.9%. The current Yield rises if the purchase ... Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Since bonds do not always trade at face value, YTM gives investors a method to calculate the yield they can expect to earn on a bond. Coupon rate is a fixed value in relation to the face value of a bond. Solved The yield to maturity of a $1,000 bond with a | Chegg.com You'll get a detailed solution from a subject matter expert that helps you learn core concepts. See Answer. The yield to maturity of a $1,000 bond with a 7.1% coupon rate, semiannual coupons, and two years to maturity is 7.9% APR, compounded semiannually. What is its price?

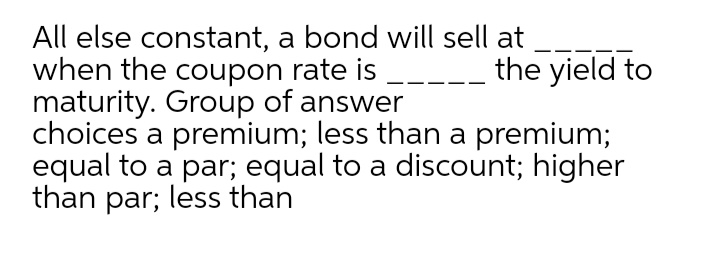

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. › ask › answersYield to Maturity – YTM vs. Spot Rate. What's the Difference? Jan 23, 2022 · A bond's yield to maturity is based on the interest rate the investor would earn from reinvesting every coupon payment. The coupons would be reinvested at an average interest rate until the bond ... Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox Using the YTM formula, the required yield to maturity can be determined. INR 950 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 40/ (1+YTM)^3+ 1000/ (1+YTM)^3 We can try out the interest rate of 5% and 6%. The bond prices for these interest rates are INR 972.76 and INR 946.53, respectively. Since the current price of the bond is INR 950. Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Yield to Maturity (YTM) Definition & Example | InvestingAnswers The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we'll use the formula mentioned above: The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don't have recurring interest payments, they don't have a coupon rate. › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? If an investor purchases a bond at par or face value, the yield to maturity is equal to its coupon rate. If the investor purchases the bond at a discount, its yield to maturity will be higher than... Coupon Rate - Meaning, Calculation and Importance - Scripbox However, the assumption is that the investor holds the bond to maturity, and all the coupon payments are reinvested at the same rate. Yield to Maturity (YTM) = { (C) + [ (FV - PV) ÷ t]} ÷ [ (FV + PV) ÷ 2] Where, C - Coupon Payment FV - Face value of the bond PV - Current price of the bond t - no. of years to maturity › terms › bBond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

Yield to Maturity Calculator | Calculate YTM Yield to maturity calculator: how to find YTM and the YTM formula. The YTM formula needs 5 inputs: bond price - Price of the bond; face value - Face value of the bond; coupon rate - Annual coupon rate; frequency - Number of times the coupon is distributed in a year; and. n - Years to maturity.

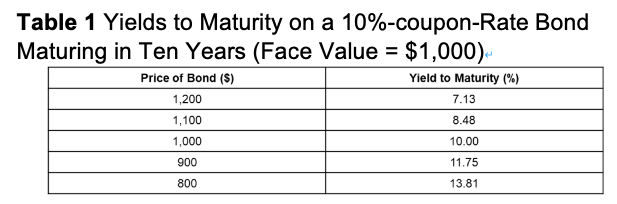

Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate. A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate. A bond is priced at a discount below par value when the coupon rate is less than the market discount rate.

Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3

What Is Coupon Rate and How Do You Calculate It? - SmartAsset Later, Investor B buys the bond for $900 as the market has heated up and a safe instrument has lost value. Coupon and yield rates are: Coupon Rate: 10%. This does not change. Investor A Yield Rate: 9%. The investor paid $1,100 for a bond that returns only $100 per year, making their yield on the bond lower than its coupon rate. Investor B Yield ...

Question - Chegg - Get 24/7 Homework Help | Rent Textbooks This problem has been solved! You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Suppose a seven-year, $1,000 bond with a 7.6% coupon rate and semiannual coupons is trading with a yield to maturity of 6.54%. a.

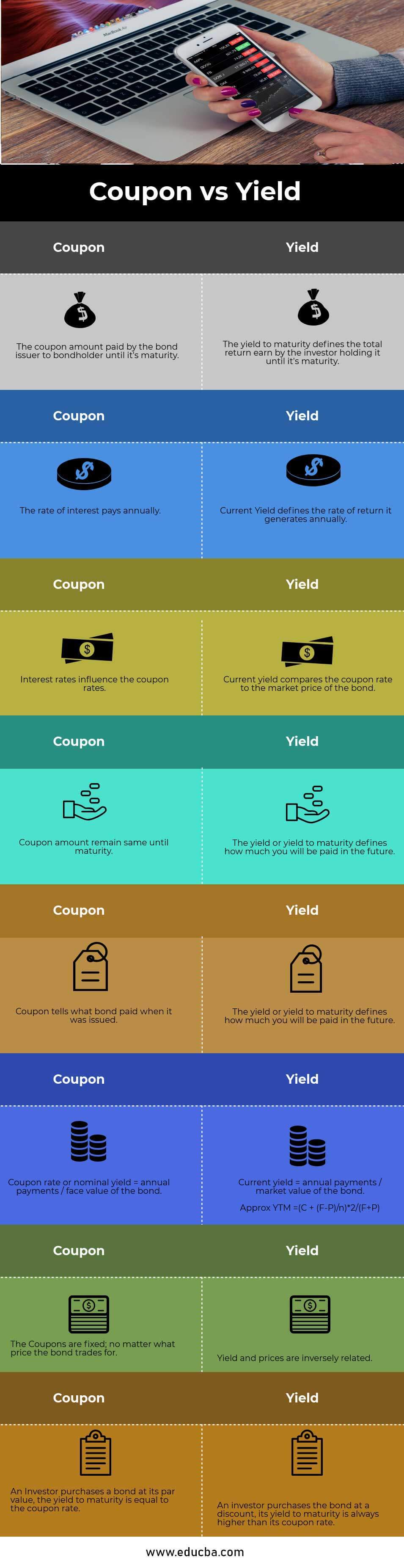

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo Yield to maturity is the effective rate of return of a bond at a particular point in time. On the basis of the coupon from the earlier example, suppose the annual coupon of the bond is $40. And the price of the bond is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = 5-Year Treasury Yield + .05% So if the 5-Year Treasury Yield is 7%, then the coupon rate for this security will be 7.5%. Now, if this coupon is revised every six months and after six months, the 5-Year Treasury Yield is 6.5%, then the revised coupon rate will be 7%.

Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

goodcalculators.com › bond-yield-to-maturityYield to Maturity Calculator | Good Calculators C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to Maturity?

Solved Suppose a ten-year, bond with an coupon rate and - Chegg Suppose a ten-year, bond with an coupon rate and semiannual coupons is trading for . a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? b. If the bond's yield to maturity changes to APR, what will be the bond's price? a.

On this page is a bond duration calculator. It will compute the mean ... Step #5: Click the "Calculate Yield to Maturity" button, which will display the information you will need to compare the entered bond with those that have different maturities, prices, and coupon rates. This calculator shows the current yield and yield to maturity on a bond; with links to articles for more

Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

› ask › answersBond Yield Rate vs. Coupon Rate: What's the Difference? To understand the full measure of a rate of return on a bond, check its yield to maturity. Yield Rate A bond's yield can be measured in a few different ways. The current yield compares the coupon...

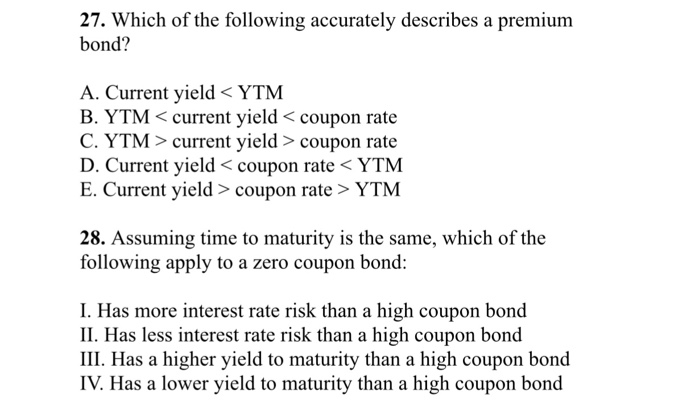

Explanation of - yay.incisione.info If the bond is selling at a premium, then rate > current yield > YTM. So you can plug in and test based on that. For a rougher estimate:. [EXCEL] Yield to maturity: Rudy Sandberg wants to invest in four-year bonds that are currently priced at $868.43. These bonds have a coupon rate of 6 percent and make semiannual coupon payments.

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury Oct 11, 2022 · NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year, semi-annually. Assuming you hold the bond to maturity, you will receive 12 coupon payments of $125 each, or a total of $1,500.

/Term-Definitions_yieldtomaturity_FINAL-bbbebc60d39345e9b5be26e89e8cb62f.png)

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

:max_bytes(150000):strip_icc()/female-executive-talking-to-colleagues-117455512-5750d4d75f9b5892e8b3d3af.jpg)

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Post a Comment for "43 coupon rate and yield to maturity"