44 how to calculate coupon rate from yield

Bond Yield Calculator | Calculate Bond Returns Determine the annual coupon rate and the coupon frequency coupon rate is the annual interest you will receive by investing in the bond, and frequency is the number of times you will receive it in a year. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest annually. Yield to Maturity (YTM): What It Is, Why It Matters, Formula - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

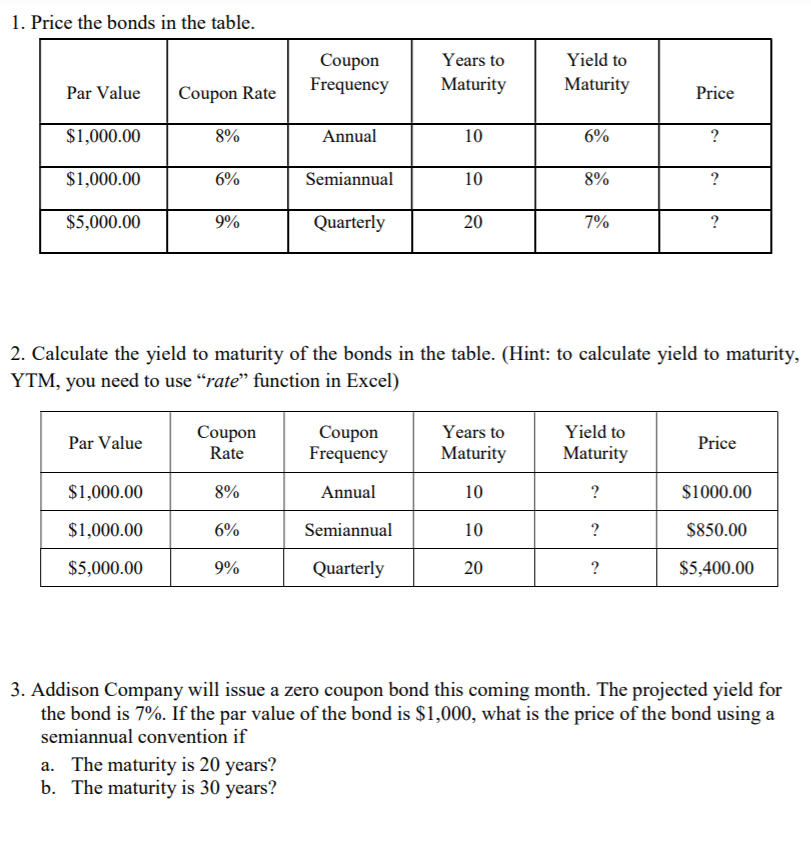

How to calculate coupon rate from yield

Here are the steps to follow for this - nsx.tomodachi-bg.info You can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to maturity, and the coupon rate. It also calculates the current yield of a bond. Fill in the form below and click the "Calculate" button to see the results. Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Annual Coupon Payment = Face Value * Coupon Rate =$1300*6% Annual Coupon Payment =$78 Step 2: Calculation of bond yield Bond Yield = Annual Coupon Payment/Bond Price =$78/$1600 Bond Yield will be - =0.04875 we have considered in percentages by multiplying with 100's =0.048*100 Bond Yield =4.875% How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow Aug 02, 2020 · If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. 2. Use the current yield to calculate the annual coupon payment. ... For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. 3 ...

How to calculate coupon rate from yield. How to Calculate Current Yield (Formula and Examples) Individual bonds pay a fixed sum of money, also called a coupon or nominal yield, each year. You can typically find this as a percentage of the bond's face value or a coupon rate. The formula for coupon rate is: Coupon rate = (total annual coupon payment / par value of bond) x 100 Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. Yield to Maturity (YTM): What It Is, Why It Matters, Formula For example, say an investor currently holds a bond whose par value is $100. The bond is currently priced at a discount of $95.92, matures in 30 months, and ... Zero-Coupon Bond: Definition, How It Works, and How To Calculate May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · Coupon rate, also known as the nominal rate, nominal yield or coupon payment, ... To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ... What Is a Coupon Rate? How To Calculate Them & What They're Used For Coupon rates can be determined by dividing the sum of the annual coupon payments by the actual bond's face value. However, this is not the same as the interest rate. For instance, a bond with a face value of $5,000 and a coupon of 10%, pays $500 every year. However, if you buy a bond above its face value, let's say at $7,000, you will get a ... Coupon Rate Definition - Investopedia A coupon rate is the yield paid by a fixed income security, which is the annual coupon payments divided by the bond's face or par value.

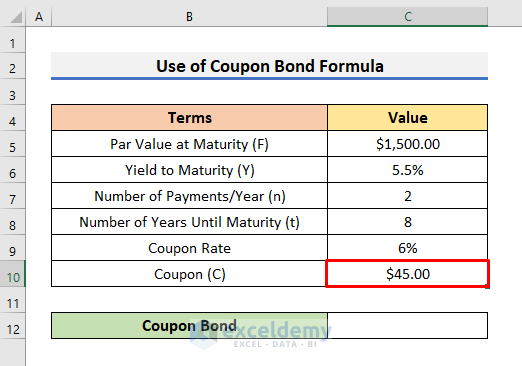

Coupon Payment Calculator Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 With the coupon payment calculator, you can find the periodic coupon payment for any bond by simply inputting the number of payments per year on the bond indenture. Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. A bond's coupon rate is the periodic distribution the holder receives. Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

How to Calculate an Interest Payment on a Bond: 8 Steps - wikiHow Dec 10, 2021 · The coupon rate may also be called the face, nominal, or contractual interest rate. Multiply the bond’s face value by the coupon interest rate to get the annual interest paid. If the interest is paid twice a year, divide this number by 2 to get the total of each interest payout. If it’s paid monthly, divide the annual interest by 12. Keep ...

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years.

Coupon Rate: Formula and Bond Calculation (Step-by-Step) - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the interest rate pricing on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6%

Coupon Rate - Explained - The Business Professor, LLC What is a Coupon Rate? A coupon rate refers to the annual interest amount that a bondholder receives usually based on the bonds face value. A coupon rate is the bond interest an issuer pays to a bondholder on its issue date. Any change in the value of the bond changes the yield, a situation that gives yield to maturity of the bond.

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate...

How Can I Calculate a Bond's Coupon Rate in Excel? In cell A2, enter the number of coupon payments you receive each year. If the bond pays interest once a year, enter 1. If you receive payments semi-annually, ...

Current Yield: Formula and Calculator (Step-by-Step) - Wall Street Prep But for the discount bond, the yield (6.32%) is higher than the coupon rate, whereas the opposite is true for the premium bond (5.71%). Conversely, another method to calculate the current yield is to divide the coupon rate by the bond quote (% of par) - with the result then multiplied by 100.

Learn to Calculate Yield to Maturity in MS Excel - Investopedia Mar 21, 2022 · Suppose the coupon rate on a $100 bond is 5%, meaning the bond pays $5 per year, and the required rate—given the risk of the bond—is 5%. Because these two figures are identical, the bond will ...

How Do I Calculate Yield in Excel? - Investopedia Jul 08, 2021 · To calculate the current yield of a bond in Microsoft Excel, enter the bond value, the coupon rate, and the bond price into adjacent cells (e.g., A1 through A3). In cell A4, enter the formula ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia In general, a bond's coupon rate will be comparable with prevailing interest rates when it is first issued. How Do You Calculate Yield Rate? A bond's yield, or coupon rate, is...

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ...

Bond Yield: What It Is, Why It Matters, and How It's Calculated If a bond has a face value of $1,000 and made interest or coupon payments of $100 per year, then its coupon rate is 10% ($100 / $1,000 = 10%). Practice trading ...

Coupon Rate Formula | Simple-Accounting.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year.

Bond - eaxdal.tomodachi-bg.info Bond's face value (nominal value) which is its book value; Bond's coupon rate (interest rate).The equations that the algorithm is based on are: Current bond yield = Annual interest payment / Bond's current clean price; Annual interest payment = Bond's face value * Bond's coupon rate (interest rate) * .01.As the bond has no interest payments, the only cash flow is the face value of the ...

Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ...

When a Bond's Coupon Rate Is Equal to Yield to Maturity A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, ...

Calculate The calculator, uses the following formula and methodology to compute the yields: Current Yield = (Face Value * Coupon Rate / 100) / Current Value . Yield to Maturity is calculated using a Javascript implementation of the. Current Yield Definition. Using the free online Current Yield Calculator is so very easy that all you have to do to ...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow Aug 02, 2020 · If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. 2. Use the current yield to calculate the annual coupon payment. ... For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. 3 ...

Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Annual Coupon Payment = Face Value * Coupon Rate =$1300*6% Annual Coupon Payment =$78 Step 2: Calculation of bond yield Bond Yield = Annual Coupon Payment/Bond Price =$78/$1600 Bond Yield will be - =0.04875 we have considered in percentages by multiplying with 100's =0.048*100 Bond Yield =4.875%

Here are the steps to follow for this - nsx.tomodachi-bg.info You can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to maturity, and the coupon rate. It also calculates the current yield of a bond. Fill in the form below and click the "Calculate" button to see the results.

:max_bytes(150000):strip_icc()/terms_b_bond-yield_FINAL-3ab7b1c73e8b487a9e860f0a5ca6dd6b.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "44 how to calculate coupon rate from yield"