45 advantage of zero coupon bonds

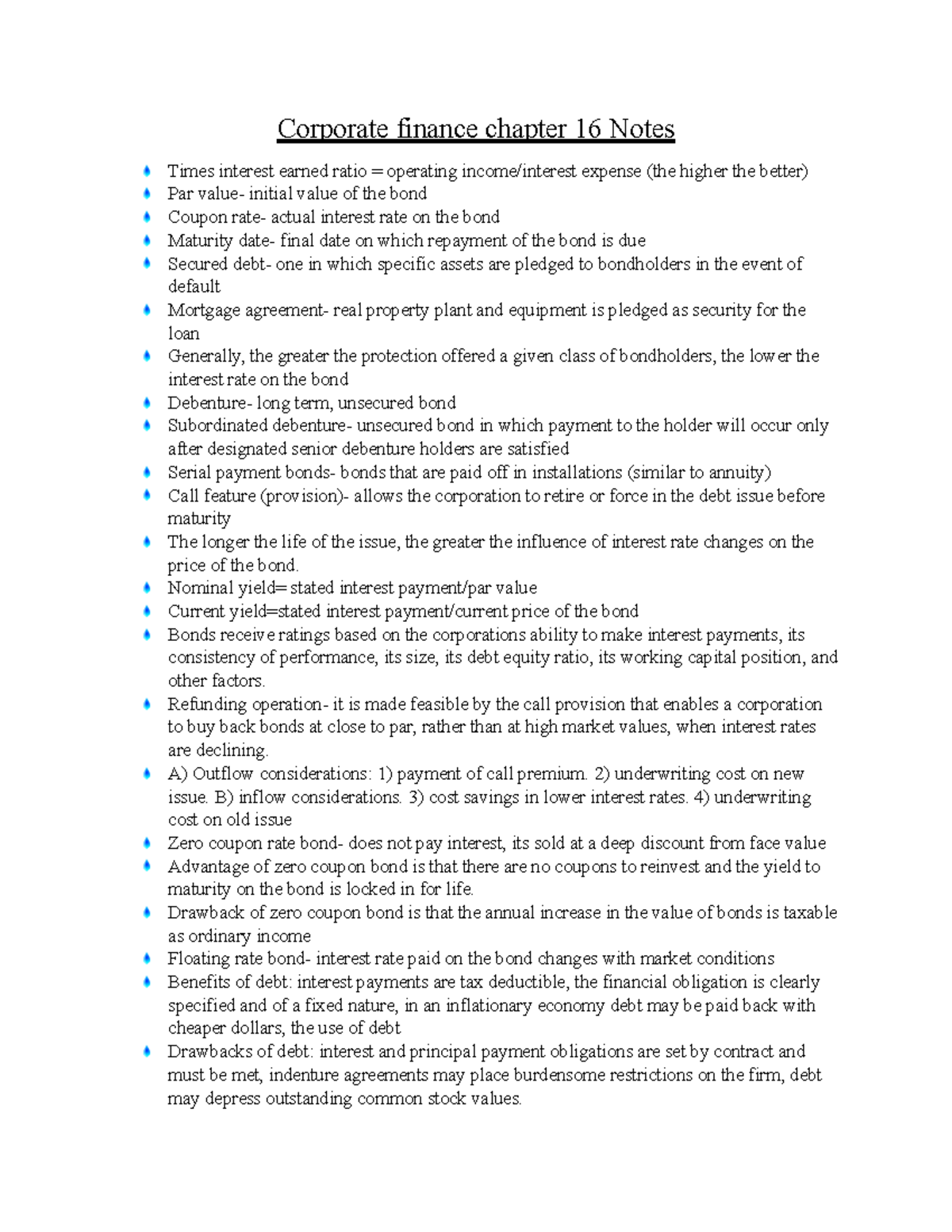

Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom Zero coupon bonds come with several benefits. The biggest is the predictability of returns. If an investor does not sell the bond prior to maturity, he/she does not have to worry about market fluctuations since the future value of the investment is known. How do you make money with a zero-coupon bond? What Is a Zero-Coupon Bond? - Investopedia Because they offer the entire payment at maturity, zero-coupon bonds tend to fluctuate in price, much more so than coupon bonds. 1 A bond is a portal through which a corporate or...

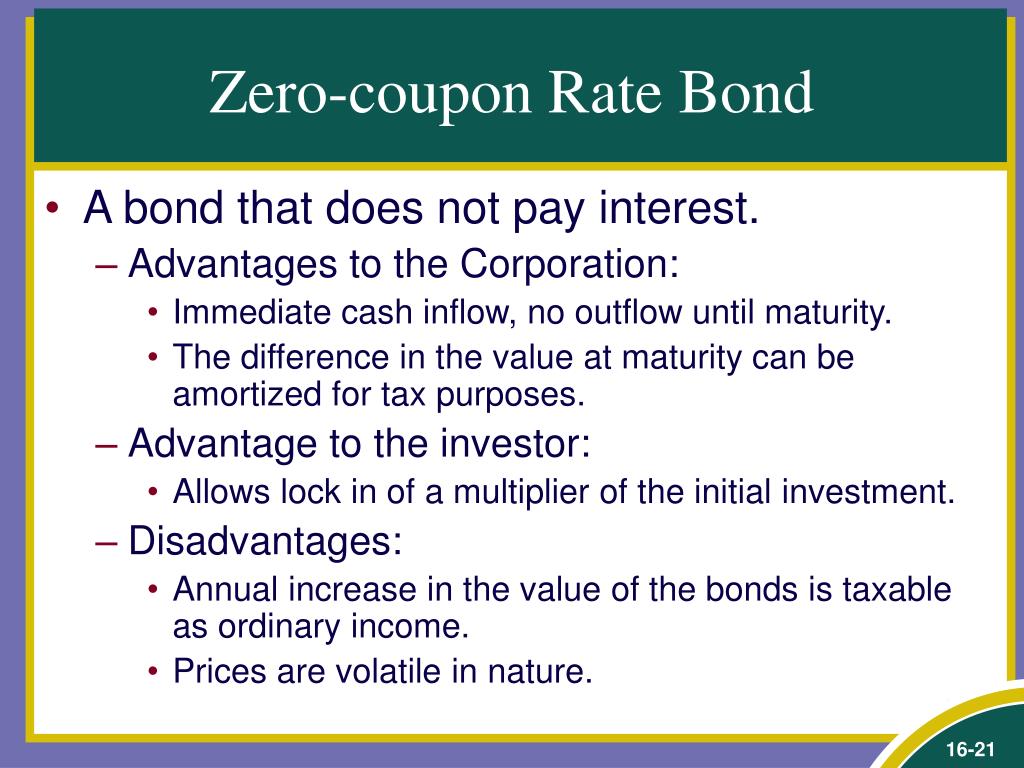

Zero Coupon Bond: Definition, Features & Formula Traditional coupon bonds with periodic interest payments have various advantages when compared to zero-coupon bonds, including being a reliable source of income for the bondholder. Lending is further de-risked by the interest payments from a conventional bond. This is done by raising the maximum possible loss floor.

Advantage of zero coupon bonds

A zero-coupon bond is a discounted investment that can help you save ... Advantages of zero-coupon bonds They often have higher interest rates than other bonds. Since zero-coupon bonds do not provide regular interest payments, their issuers must find a way to make them ... › sitemapSitemap - ICICI Bank Now personalize your Debit Card as you like. Pick and choose from a gallery of 200+ awesome designs or choose one of your own pics and flaunt it all the way Home | NextAdvisor with TIME Webconst FP = {“featured_posts_nonce”:”76c9f46ca0″,”featured_posts”:[{“description”:”How these Latinx and Black founders leveraged their stories to put ...

Advantage of zero coupon bonds. What are Zero Coupon Bonds? | Features, Advantages, Disadvatages As discussed earlier, the return for investors in the case of a zero coupon bond is equal to the difference between its issue price and redemption price. Maturity Period. ZCBs are issued for a minimum period of 10 years. Advantages of Zero Coupon Bonds. Let us look at some of the reasons why an investor should invest in ZCBs. Long-Term in Nature What Is a Zero-Coupon Bond? Definition, Advantages, Risks Advantages of zero-coupon bonds They often have higher interest rates than other bonds Since zero-coupon bonds do not provide regular interest payments, their issuers must find a... What are the benefits to the issuers of zero-coupon bonds? The biggest advantage of a zero-coupon bond is its predictability. If you do not sell the bond prior to maturity, you do not have to worry about market ups and downs since you know what your investment will be worth at a particular future date. Hey dears, We have the most profitable stock trading chat room with live trade alerts. The One-Minute Guide to Zero Coupon Bonds | FINRA.org This feature offers protection from the risk that you will have to settle for a lower rate of return if your bond is called, you receive cash, and you need to reinvest it (this is known as reinvestment risk). That said, zero-coupon bonds carry various types of risk.

PPIC Statewide Survey: Californians and Their Government Web26.10.2022 · Key Findings. California voters have now received their mail ballots, and the November 8 general election has entered its final stage. Amid rising prices and economic uncertainty—as well as deep partisan divisions over social and political issues—Californians are processing a great deal of information to help them choose state constitutional … What Are Zero Coupon Bonds And Their Risks- Tavaga | Tavagapedia What is a Zero-Coupon Bond? Zero-coupon bond or ZCB is a financial instrument that does not pay any interest or coupon rate but is, instead, issued at a deep discount and is redeemed at face value on maturity. The return earned by the investor is the difference between the issue price and the redemption price. Yield to maturity of Zero-Coupon ... What are the advantages and disadvantages of zero-coupon bond? What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival. What is a Zero Coupon Bond? Who Should Invest? | Scripbox A zero coupon bond is a type of fixed income security that does not pay any interest to the bondholder. It is also known as a discount bond. These bonds are issued at a discount to the face value. In other words, it trades at a deep discount. On maturity, the bond issuer pays the face value of the bond to the bondholder.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Here are the key differences between Zero-coupon Bond and Regular Coupon Bearing Bond Advantages #1 - Predictability of Returns Zero Coupon Bonds_1 | Investing Post Advantages of Purchasing Zero Coupon Bonds. U.S. Treasury bonds offer a stable and secure investment because they are federally insured and pay a fixed rate over time. They are sold at a lower price than the face value which is paid to the holder at maturity. Another safe investment option includes U.S. Savings bonds which are backed by the ... Pros and Cons of Zero-Coupon Bonds | Kiplinger These bonds don't make regular interest payments. Instead, they're sold at a big discount to face value; when they mature, you collect the full amount. Their big advantage is that you know how ... › newsLatest Business News | BSE | IPO News - Moneycontrol Latest News. Get all the latest India news, ipo, bse, business news, commodity only on Moneycontrol.

Zero-Coupon Bonds | AnnuityAdvantage For example, a zero-coupon bond with a face value of $5,000, a maturity date of 20 years, and a 5% interest rate might cost only a few hundred dollars. When the bond matures, the bondholder receives the face value of the bond ($5,000 in this case), barring default. The value of zero-coupon bonds is subject to market fluctuations.

abcnews.go.com › USU.S. News | Latest National News, Videos & Photos - ABC News ... Nov 22, 2022 · Get the latest breaking news across the U.S. on ABCNews.com

How to Invest in Bonds | The Motley Fool Web24.11.2022 · Some bonds, known as zero-coupon bonds, offer a return once they’ve matured. Because these bonds don’t pay interest, they are usually sold for a deep discount to their face value.

Stock Quotes, Business News and Data from Stock Markets | MSN … Web23.11.2022 · Get the latest headlines on Wall Street and international economies, money news, personal finance, the stock market indexes including Dow Jones, NASDAQ, and more. Be informed and get ahead with ...

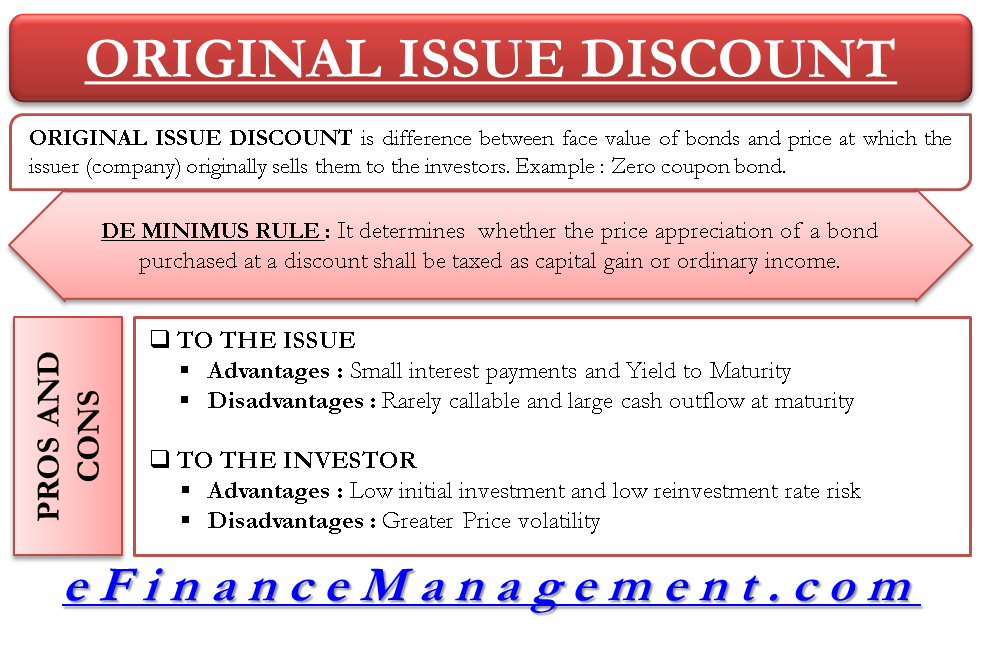

Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink The term "Zero Coupon Bond" has been defined by Section-2(48) of the Income Tax Act as below: - ... Further, the most important advantage of the zero coupon bonds is that no tax is payable on interest element if you invest in notified zero coupon bonds. These are subject to capital gains tax only.

What Is The Advantage Of Investing In A Zero Coupon Bond - Atish Lolienkar Bonds with zero coupons are issued at a discount and redeemed at face value. On such bonds, no interest is paid at regular intervals before maturity. The price at which Zero Coupon Bonds are offered for purchase is substantially lower than the bond's face value. Thus, offering an investor an advantage to begin their investment at low valuations.

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww No regular income: The Zero Coupon bond provides in a lump sum; therefore, it prevents a regular cash flow. This bond will not benefit investors with the requirement of regular cash. Interest Rate Risk: Interest rates of this bond can decline over time due to fluctuation in the market.

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Advantages of Zero-Coupon U.S. Treasury Bonds Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right...

The Pros and Cons of Zero-Coupon Bonds - m.finweb.com Here are some of the pros and cons of investing in zero-coupon bonds. Pros One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this type of long-term proposition, companies have to be willing to pay higher interest rates.

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond doesn't pay interest, but it could pay off for your portfolio. Choosing between the many different types of bonds may require a plan for your broader investments. A zero coupon bond often requires less money up front than other bonds. Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates.

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Some of the advantages of these bonds have been mentioned below: Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more.

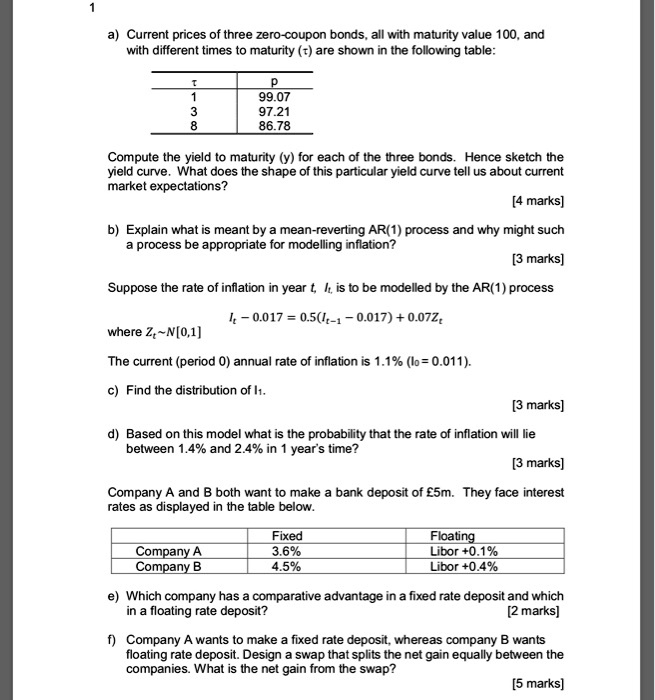

The Zero Coupon Bond: Pricing and Charactertistics This means if we pay something around $72 (100-28) on December 1, 1996 for the $100 coupon due on December 1, 2001, we will earn something around 30% over the period or 6% a year. Pulling out our trusty bond calculator, we can actually do the calculation. At a semi-annual yield of 5.6%, the price works out to be $75.91.

Zero-Coupon Bonds - Accounting Hub Advantages of Zero-Coupon Bonds. Zero-coupon bonds offer several benefits to issuers and investors. These bonds are less volatile and offer predictable returns to investors. Investors are assured of fixed income at maturity, so it eliminates the reinvestment risk as there are no periodic repayments. These bonds require a low initial investment.

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia Zero coupon bonds can work to your advantage, if used judiciously and in tandem with your investment objectives. Without any intermittent coupon payments, the calculation of yield to maturity of a zero-coupon bond is as follows: (Face value/ current market price) *(1/years to maturity) - 1;

Join LiveJournal WebPassword requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

Could Call of Duty doom the Activision Blizzard deal? - Protocol Web14.10.2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal.

What is a Zero-Coupon Bond? Definition, Features, Advantages ... Advantages of Zero-Coupon Bond A zero-coupon bond is a secured form of investment when done for the long term. The various benefits it can provide are mentioned below: Predictable Returns: The return on a deeply discounted bond after maturity, is pre-known to the investor in the form of par value or face value.

Unbanked American households hit record low numbers in 2021 Web25.10.2022 · Those who have a checking or savings account, but also use financial alternatives like check cashing services are considered underbanked. The underbanked represented 14% of U.S. households, or 18. ...

› terms › bBond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

Latest News | Latest Business News | BSE | IPO News - Moneycontrol WebLatest News. Get all the latest India news, ipo, bse, business news, commodity only on Moneycontrol.

Assignment Essays - Best Custom Writing Services WebBest Custom Writing Services. Need help with your assignment essay? We got you covered! We have helped thousands of students with their Essays, Assignments, Research Papers, Term Papers, Theses, Dissertations, Capstone Projects, etc.

Zero-coupon bond - Wikipedia Zero coupon bonds have a duration equal to the bond's time to maturity, which makes them sensitive to any changes in the interest rates. Investment banks or dealers may separate coupons from the principal of coupon bonds, which is known as the residue, so that different investors may receive the principal and each of the coupon payments.

Advantages and Risks of Zero Coupon Treasury Bonds Web31.01.2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time.

What are Zero-coupon Bonds? The question, what is the benefit of zero coupon bonds can be summed up as below: 1. Inverse relation to interest rates Zero-coupon bonds can appreciate quite greatly when RBI cuts the market interest rates. If you have a portfolio of zero-coupon bonds, you may see appreciation in your profitability.

› fixed-income-bonds › individualMunicipal Bonds - Fidelity Zero-coupon bonds Zero-coupon municipal bonds are issued at an original issue discount, with the full value, including accrued interest, paid at maturity. Interest income may be reportable annually, even though no annual payments are made. Market prices of zero-coupon bonds tend to be more volatile than bonds that pay interest regularly.

› newsletters › entertainmentCould Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal.

| Personal Finance Site To Help You Find More ... Check Out Our Free Newsletters! Every day, get fresh ideas on how to save and make money and achieve your financial goals.

Home | NextAdvisor with TIME Webconst FP = {“featured_posts_nonce”:”76c9f46ca0″,”featured_posts”:[{“description”:”How these Latinx and Black founders leveraged their stories to put ...

› sitemapSitemap - ICICI Bank Now personalize your Debit Card as you like. Pick and choose from a gallery of 200+ awesome designs or choose one of your own pics and flaunt it all the way

A zero-coupon bond is a discounted investment that can help you save ... Advantages of zero-coupon bonds They often have higher interest rates than other bonds. Since zero-coupon bonds do not provide regular interest payments, their issuers must find a way to make them ...

Post a Comment for "45 advantage of zero coupon bonds"