40 yield to maturity of a coupon bond formula

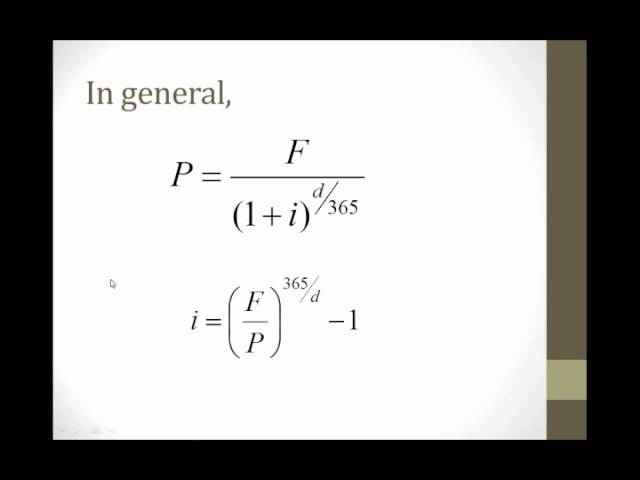

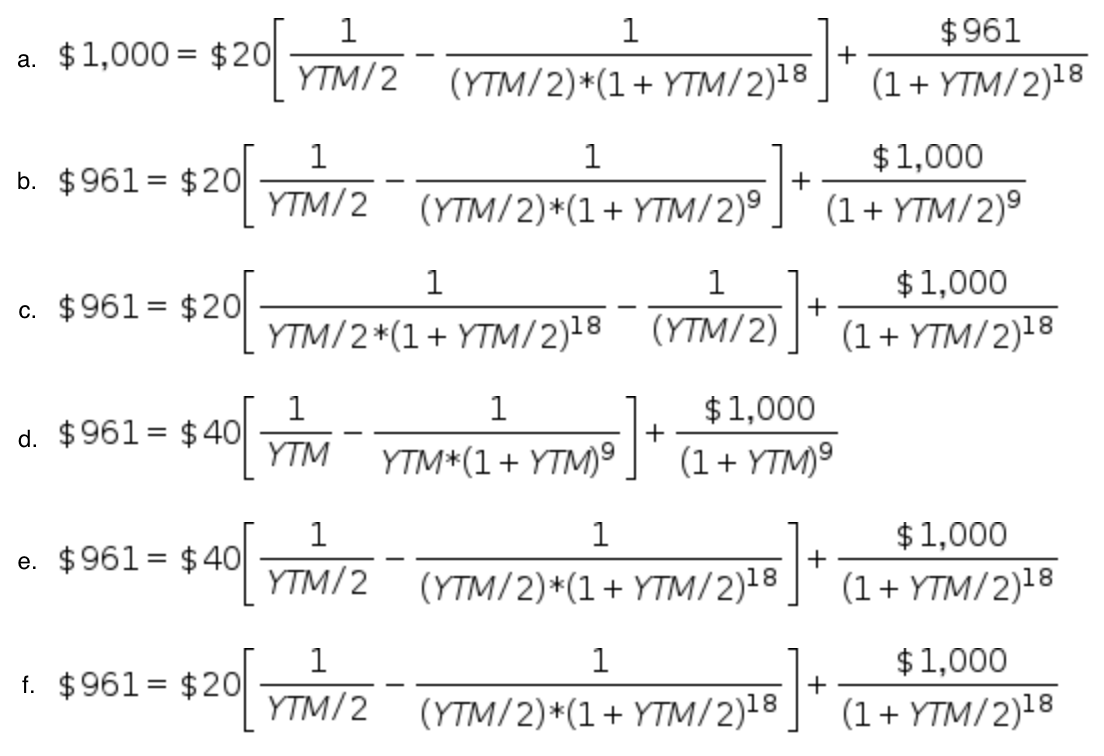

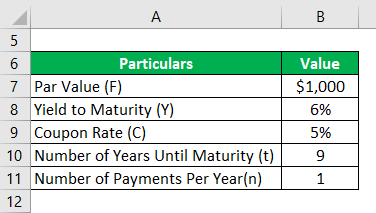

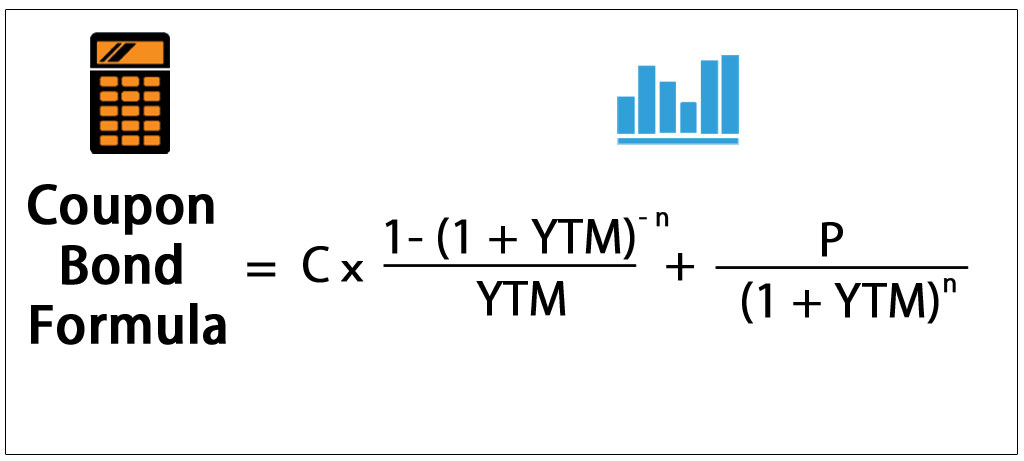

Bond Basics: Issue Size and Date, Maturity Value, Coupon May 28, 2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. Yield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ...

Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments.

Yield to maturity of a coupon bond formula

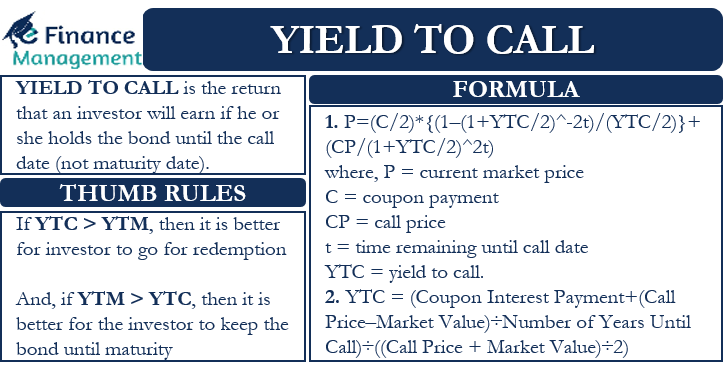

Yield to Maturity (YTM) - Definition, Formula, Calculation ... 6 steps Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Learn to Calculate Yield to Maturity in MS Excel - Investopedia Mar 21, 2022 · Suppose the coupon rate on a $100 bond is 5%, meaning the bond pays $5 per year, and the required rate—given the risk of the bond—is 5%. Because these two figures are identical, the bond will ...

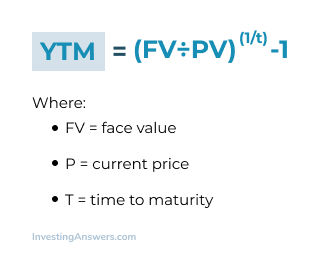

Yield to maturity of a coupon bond formula. Yield to Maturity (YTM): Formula, Meaning & Calculation What is Yield to Maturity (YTM) and Its Formula? · Annual Interest = Annual Interest Payout by the Bond · FV = Face Value of the Bond · Price = Current Market ... Bond Yield Formula | Step by Step Calculation & Examples The bond yield formula evaluates the returns from investment in a given bond. It is calculated as the percentage of the annual coupon payment to the bond price. The annual coupon payment is calculated by multiplying the bond’s face value with the coupon rate. Yield to maturity - Fixed income - Robeco The YTM can be used to evaluate the current valuation of a bond by comparing it with its coupon rate, where the latter is a simpler calculation of the ... Yield to Maturity – What it is, Use, & Formula - Speck & Company There are two formulas for yield to maturity depending on the bond. The yield to maturity formula for a zero-coupon bond: Yield to maturity = [(Face Value / ...

Yield to Maturity (YTM): Formula and Calculator Yield to Maturity of Bond Calculation Example · Semi-Annual Coupon Rate (%) = 6.0% ÷ 2 = 3.0% · Number of Compounding Periods (n) = 10 × 2 = 20 · Annual Coupon (C) ... Yield to Maturity (YTM) - Overview, Formula, and Importance 7 May 2022 — The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... n = years until maturity times 2; The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating ... Yield to Maturity Formula & Examples | How to Calculate YTM 16 Dec 2021 — Face value = 100; Coupon or interest rate = 3% (using 30 INR); Maturity time: 2 years; Current market value = 90.

Learn to Calculate Yield to Maturity in MS Excel - Investopedia Mar 21, 2022 · Suppose the coupon rate on a $100 bond is 5%, meaning the bond pays $5 per year, and the required rate—given the risk of the bond—is 5%. Because these two figures are identical, the bond will ... Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Yield to Maturity (YTM) - Definition, Formula, Calculation ... 6 steps

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Post a Comment for "40 yield to maturity of a coupon bond formula"