41 duration for zero coupon bond

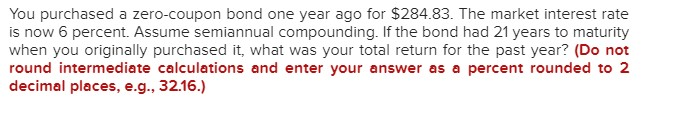

Zero Coupon Bond Modified Duration Formula - Bionic Turtle Zero-coupon bonds are popular (in exams) due to their computational convenience. We barely need a calculator to find the modified duration of this 3-year, zero-coupon bond. Its Macaulay duration is 3.0 years such that its modified duration is 2.941 = 3.0/(1+0.04/2) under semi-annually compounded yield of 4.0%. Zero Coupon Bond | Definition, Formula & Examples - Video & Lesson ... Zero-Coupon Bond Formula: Zero-coupon bonds are real-life applications of the time value of money concept which underlines that $100 now is worth more than $100 in the future.

Macaulay Duration - Overview, How To Calculate, Factors Modified duration can be calculated by dividing the Macaulay duration of the bond by 1 plus the periodic interest rate, which means a bond's Modified duration is generally lower than its Macaulay duration. If a bond is continuously compounded, the Modified duration of the bond equals the Macaulay duration. In the example above, the bond shows a Macaulay duration of 1.915, and the semi-annual interest is 2.5%. Therefore, the Modified duration of the bond is 1.868 (1.915 / 1.025). It means ...

Duration for zero coupon bond

The Macaulay Duration of a Zero-Coupon Bond in Excel Calculating the Macauley Duration in Excel Assume you hold a two-year zero-coupon bond with a par value of $10,000, a yield of 5%, and you want to calculate the duration in Excel. In columns A and... Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula. Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1; Zero-Coupon Bond Risks What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

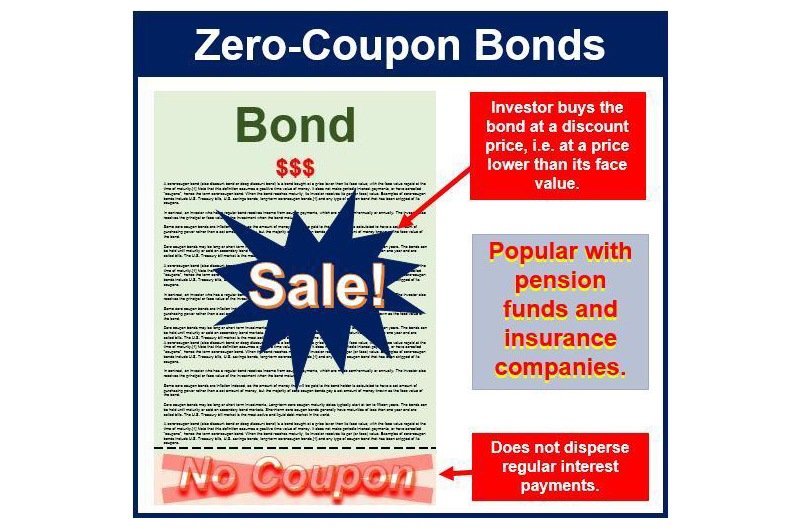

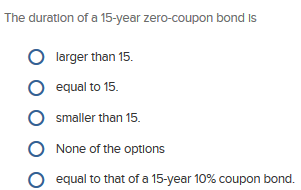

Duration for zero coupon bond. Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ... Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... Mr. Tee is looking to purchase a zero-coupon bond that has a face value of $50 and has 5 years till maturity. The interest rate on the bond is 2% and will be compounded annually. In the scenario above, the face value of the bond is $50. However, to calculate the price that needs to be paid for the bond today, the following formula is used: MC Explains | What is a 'zero-coupon, zero-principal' instrument? With its zero-coupon, zero-principal structure, it resembles a debt security like a bond. When an entity takes a loan by issuing regular debt security like a bond, it has to make interest payments ... PDF Understanding Duration - BlackRock • The lower a bond's coupon, the longer its duration, because proportionately less payment is received before final maturity. The higher a bond's coupon, the shorter its duration, because proportionately more payment is received before final maturity. • Because zero coupon bonds make no coupon payments, a zero coupon bond's duration will be equal to its maturity. • The longer a bond's maturity, the longer

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest. Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n. PV - 1. Here; F represents the Face or Par Value. PV represents the Present Value. n represents the number of periods. I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond. Bond Duration Calculator - Macaulay and Modified Duration - DQYDJ From the series, you can see that a zero coupon bond has a duration equal to it's time to maturity - it only pays out at maturity. Example: Compute the Macaulay Duration for a Bond. Let's compute the Macaulay duration for a bond with the following stats: Par Value: $1000; Coupon: 5%; Current Trading Price: $960.27; Yield to Maturity: 6.5%; Years to Maturity: 3 Zero coupon, zero principal bond declared securities The Finance Ministry has declared zero coupon zero principal instruments (ZCZP) as securities. Experts say this will help many organisations including corporates to utilise their fund marked for ...

What is a Zero Coupon Bond? Who Should Invest? | Scripbox Introduction. Zero coupon bonds are fixed income securities that don't pay any interest. At the time of maturity, the investor is paid the face value or par value. These bonds come with 10-15 years maturity.Hence, they trade at a deep discount. The bond pricing varies with time to maturity.. The higher the time until maturity, lower will be the price the investor will be willing to pay. Default Risk and the Duration of Zero Coupon Bonds This paper applies a contingent claims approach to examine the duration of a zero coupon bond subject to default risk. One replicating portfolio for a default-prone zero coupon bond contains a long position in the default-free asset plus a short position in a put option on the underlying assets. The duration of the bond is shown to be a ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero Coupon Bond -Features, benefits, drawbacks, taxability, & FAQs Duration in a zero-coupon bond is the time to maturity. Normally, these bonds come with a duration of 10 years or more. How to invest in zero coupon bonds? Zero coupon bonds are issued periodically by governments and pseudo-government institutions. Once these bonds are issued, they can be bought through stock exchanges such as NSE and BSE.

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

What is the duration of a zero coupon bond? - Quora Originally Answered: what is the duration of a zero coupon bond? Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium.

Zero-Coupon Bond Definition - Investopedia The maturity dates on zero-coupon bonds are usually long-term, with initial maturities of at least 10 years. These long-term maturity dates let investors plan for long-range goals, such as saving...

duration of zero coupon bonds | Forum | Bionic Turtle With respect to a zero coupon bond, Macaulay duration = maturity, and therefore must be a monotonically increasing function of maturity. On the other hand, DV01 of a zero (or deeply discounted) is not strictly increasing as DV01 = P*D/10,000 and the numerator has offsetting effects. If you'd kindly reference, I can fix? Thanks! Apr 7, 2012 #3 S

Bond duration - Wikipedia For a standard bond, the Macaulay duration will be between 0 and the maturity of the bond. It is equal to the maturity if and only if the bond is a zero-coupon bond . Modified duration, on the other hand, is a mathematical derivative (rate of change) of price and measures the percentage rate of change of price with respect to yield.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

Zero-coupon bond - Wikipedia Some zero coupon bonds are inflation indexed, and the amount of money that will be paid to the bond holder is calculated to have a set amount of purchasing power, rather than a set amount of money, but most zero coupon bonds pay a set amount of money known as the face value of the bond. Zero coupon bonds may be long or short-term investments. Long-term zero coupon maturity dates typically start at ten to fifteen years. The bonds can be held until maturity or sold on secondary bond markets ...

What is the period of a zero coupon bond? - personal-accounting The bond issuer pays interest to the bondholders for the duration of the bond's time period. Bonds are loan agreements involving creditors and borrowers. When Convertible Bonds Become Stock. ... Zero coupon bonds have a period equal to the bond's time to maturity, which makes them sensitive to any modifications within the rates of interest. ...

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay ...

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula. Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1; Zero-Coupon Bond Risks

The Macaulay Duration of a Zero-Coupon Bond in Excel Calculating the Macauley Duration in Excel Assume you hold a two-year zero-coupon bond with a par value of $10,000, a yield of 5%, and you want to calculate the duration in Excel. In columns A and...

Post a Comment for "41 duration for zero coupon bond"