41 coupon interest rate definition

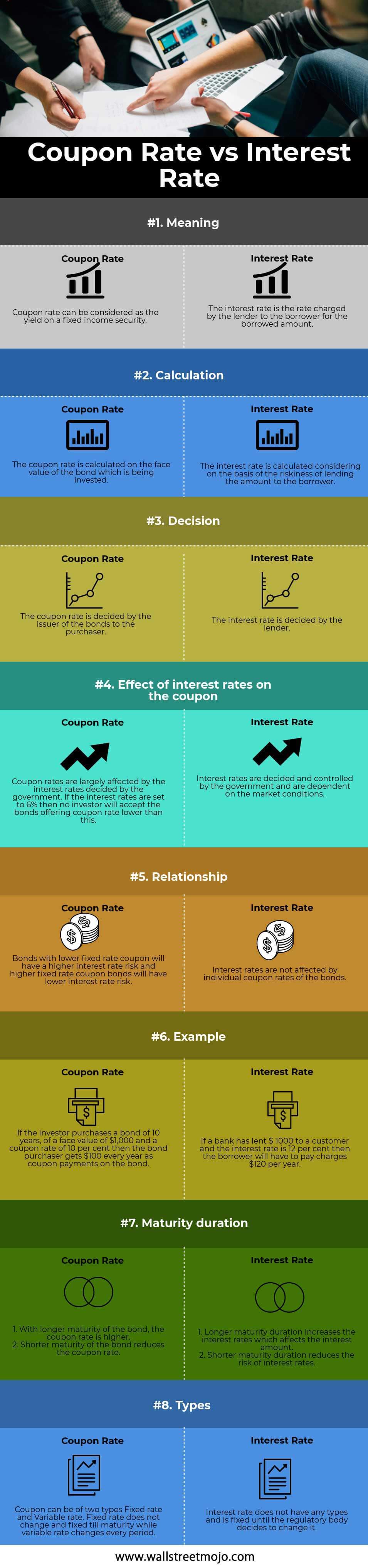

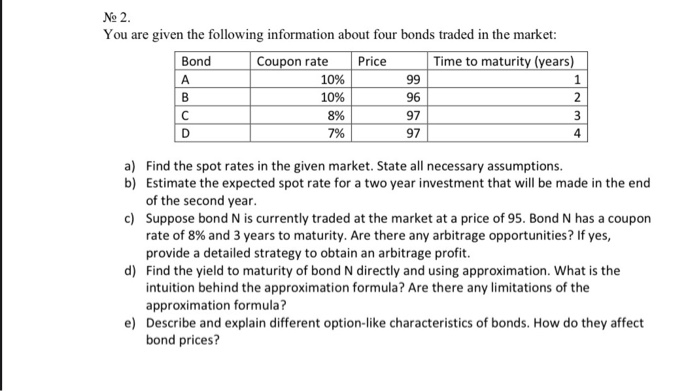

Difference Between Coupon Rate and Interest Rate (With Table) A coupon rate is an annual interest payment, which is provided by the bond issuer to the bondholder at the time of maturity. In the meantime, coming to the interest rate, it is the charges put on the payment by the lender to the borrower. Readers who read this also read: Difference Between Coupon Rate and Discount Rate (With Table) Coupon Rate | Definition - Finance Strategists May 9, 2022 — A coupon rate is the interest attached to a fixed income investment, such as a bond. When bonds are bought by investors, bond issuers are ...What does Coupon Rate mean?What is the difference between Coupon Rate and interest rate?

Coupon Rate: Definition, Formula & Calculation - Study.com The coupon rate is the annualized interest also referred to as the coupon, divided by the initial loan amount. The initial loan amount is the par value. In the example given, the coupon rate is the...

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-63d1901859ed40f5bc7533de1a31e857.jpg)

Coupon interest rate definition

Coupon Rate Definition - Investopedia A coupon rate is the yield paid by a fixed income security, which is the annual coupon payments divided by the bond's face or par value.How Are Coupon Rates Affected by Market Interest Rates?What's the Difference Between Coupon Rate and YTM? Coupon Definition - Investopedia What Is a Coupon? A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually... Junior Coupon Rate Schedule Definition | Law Insider Examples of Junior Coupon Rate Schedule in a sentence. Interest payments ("Junior Coupon Payments", and together with the Senior Coupon Payments, the "Coupon Payments") to the holders of the Junior Notes will (excluding the Junior Note Additional Interest referred to below) accrue on each Junior Note on a pro rata basis at the percentage rate per annum of the Junior Notional Amount applicable ...

Coupon interest rate definition. Coupon definition — AccountingTools A coupon is a voucher that entitles the holder to a discount on a particular purchase. The issuance of a coupon allows the seller to advertise the discounted price of a product or service, net of the coupon, while not necessarily paying the amount of the coupon; a buyer must take action to present the coupon in order to receive a discount. Only ... › calculators › financialEffective Interest Rate Calculator Nominal Interest Rate (R) is the nominal interest rate or "stated rate" in percent. r = R/100 Compounding Periods (m) is the number of times compounding will occur during a period. Continuous Compounding is when the frequency of compounding (m) is increased up to infinity. Enter c, C or Continuous for m. Effective Interest Rate (i) › finance › coupon-rateCoupon Rate Calculator | Bond Coupon A coupon is the interest payment of a bond. Typically, it is distributed annually or semi-annually depending on the bond. We usually calculate it as the product of the coupon rate and the face value of the bond. How often do I receive coupons from investing in bonds? The short answer is it depends on the bonds that you invest in. Coupon Definition & Meaning - Merriam-Webster The meaning of COUPON is a statement of due interest to be cut from a bearer bond when payable and presented for payment; also : the interest rate of a coupon. How to use coupon in a sentence.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. Government and non-government entities issue bonds to raise money to finance their operations. When a person buys a bond, the bond issuer What Is a Certificate of Deposit Coupon? | Pocketsense A coupon is the stated rate of interest on the certificate of deposit. The term comes from bonds that have coupons that must be torn off the original bond and redeemed to be paid the interest due. The interest rate specified by the coupon is paid at set intervals. What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. Coupon interest rate financial definition of coupon interest rate coupon interest rate the INTEREST RATE payable on the face value of a BOND. For example, a £100 bond with a 5% coupon rate of interest would generate a nominal return of £5 per year. See EFFECTIVE INTEREST RATE. Collins Dictionary of Economics, 4th ed. © C. Pass, B. Lowes, L. Davies 2005 Want to thank TFD for its existence?

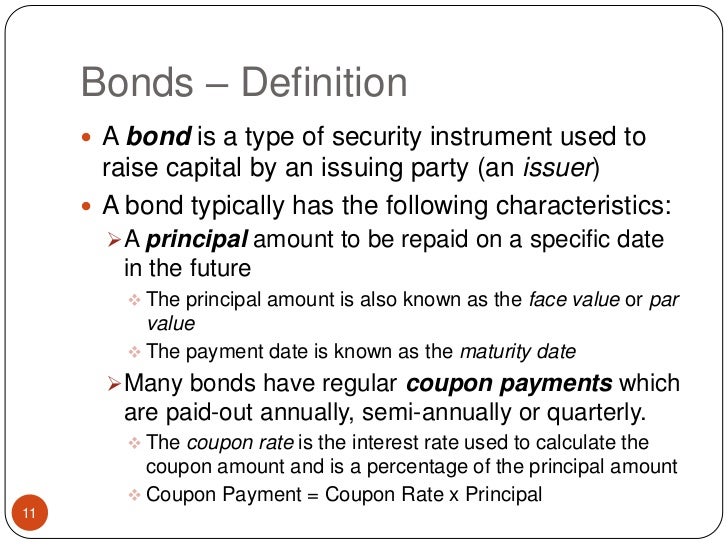

xplaind.com › 945823Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date.. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.. In fixed-coupon payments, the coupon rate is fixed and stays the same throughout the life ... Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers. Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate Definition The coupon rate, or "nominal yield," is the rate of interest paid to a bondholder by the issuer of the debt. The coupon rate on a bond issuance is used to calculate the dollar amount of coupon payments paid, i.e. the periodic interest payments by the issuer to bondholders. Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued. What Does Coupon Rate Mean?

Coupon Interest Rate: What is Coupon Interest Rate? Fixed Income ... What is Coupon Interest Rate? The Interest to be annually paid by the issuer of a bond as a percent of per value, which is specifi

Is coupon rate the same as interest rate? - AskingLot.com In this case, the coupon rate for the bond will be $40/$1000 that is a 4% annual rate. If the annual coupon of a bond is $40. And the price of the bond is $1150 then the yield on the bond will be 3.5%. Similarly one may ask, what is coupon interest rate? Definition: Coupon rate is the stated interest rate on a fixed income security like a bond ...

Coupon Interest | Insurance Glossary Definition | IRMI.com Definition Coupon Interest — the rate of interest paid to the holders of a bond. This rate can be either a floating variable or fixed rate. Often, zero coupon bonds are issued that pay no interest until the bond is redeemed to guarantee repayment of the principal of the bond or specific tranche.

› terms › iInterest Rate Swap Definition - Investopedia Aug 31, 2021 · Interest Rate Swap: An interest rate swap is an agreement between two counterparties in which one stream of future interest payments is exchanged for another based on a specified principal amount ...

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

› terms › iInterest Rate Sensitivity Definition - Investopedia Dec 12, 2020 · Interest rate sensitivity is a measure of how much the price of a fixed-income asset will fluctuate as a result of changes in the interest rate environment. Securities that are more sensitive have ...

Difference Between Coupon Rate and Required Return (With Table) Coupon Rate: Required Return: Definition: The coupon rate is the amount of interest that the buyer of the bond will receive annually. The required return is the percentage of return of bond assuming that the asset is withheld by the investor until the bond matures. Formula Coupon rate = ( Total annual payment/par value of bond) * 100

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail.

Learn About Coupon Interest Rates | Chegg.com As defined above, the coupon interest rate is defined as the nominal or ostensible yield to be paid by the issuer on the bond which was decided on its date of issue. The coupon interest rate often fluctuates when the value of the bond changes.

Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower.

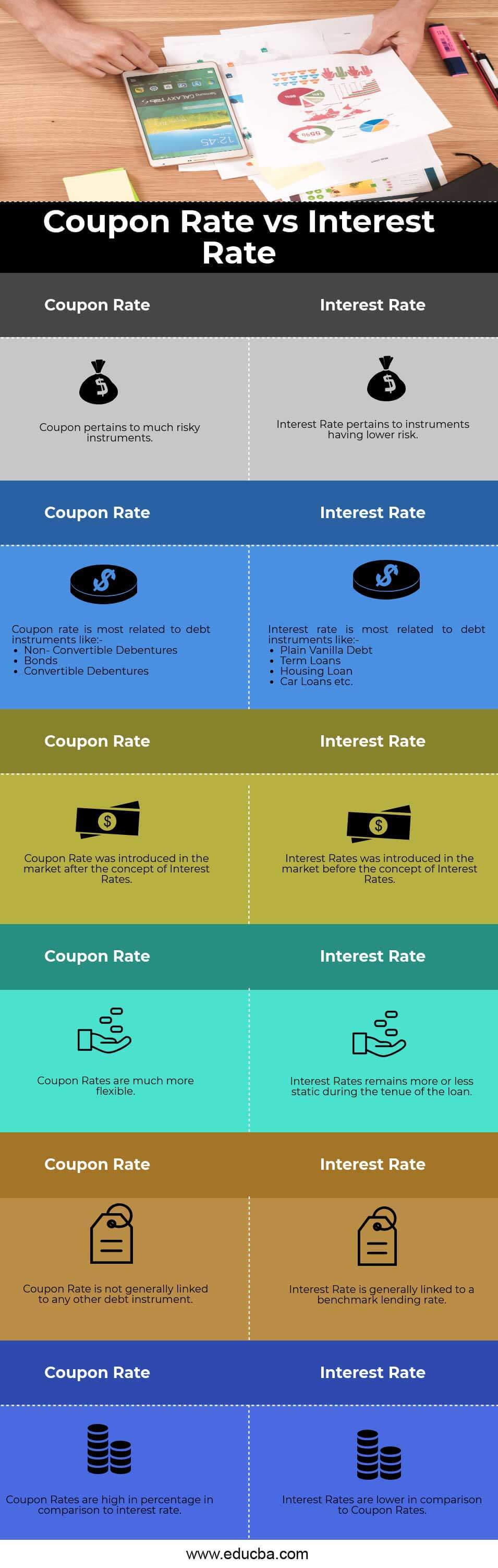

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) The coupon rate is the rate of interest being paid off for the fixed income security such as bonds. This interest is paid by the bond issuers where it is being calculated annually on the bonds face value, and it is being paid to the purchasers.

Coupon rate financial definition of Coupon rate The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons.

Coupon Rate Formula & Calculation - Video & Lesson Transcript Apr 8, 2022 — Coupon Rate Formula · Identify the par value of the bond. · Identify the frequency of periodic payments (or coupon payments) that have been made.What is coupon rate in simple words?How do you calculate coupon rate?

Difference Between Coupon Rate and Interest Rate Interest rate is the rate charged for a borrowing. • Coupon Rate is calculated considering the face value of the investment. Interest rate is calculated considering the riskiness of the lending. • Coupon rate is decided by the issuer of the securities. Interest rate is decided by the lender.

Junior Coupon Rate Schedule Definition | Law Insider Examples of Junior Coupon Rate Schedule in a sentence. Interest payments ("Junior Coupon Payments", and together with the Senior Coupon Payments, the "Coupon Payments") to the holders of the Junior Notes will (excluding the Junior Note Additional Interest referred to below) accrue on each Junior Note on a pro rata basis at the percentage rate per annum of the Junior Notional Amount applicable ...

Coupon Definition - Investopedia What Is a Coupon? A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually...

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Value_Interest_Rate_Swaps_Sep_2020-01-4b6f55263e5a41b091bded09d63da811.jpg)

Post a Comment for "41 coupon interest rate definition"